How to Read an Experian Credit Report

How do I read a credit report?

Here are the most important factors to pay attention to on a credit report:

- The credit score/credit score factors. what is a good credit score.

The score reflects all aspects of the report that indicate whether or not the consumer is likely to pay their bills on time. Higher the better, avg score for renters is about 625. Credit score factors point out key aspects of the report that brought the score down. Every report will have at least 4 factors.

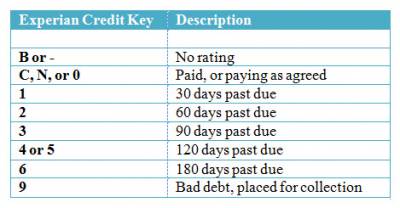

- The payment history. The payment history is found in the far right column of each section. The history will show if the consumer has been current with their payments (shown with the letter "C") or how many months late their payment was( "1, 2, 3, 4, etc"), or if the account is derogatory or in collections, reported as a "9." C's are good, numbers in the payment history indicate the payments were late or are now in collection status.

READING A CREDIT REPORT SECTION BY SECTION

READING A CREDIT REPORT CAN BE CONFUSING, SO LET'S START FROM THE TOP:

1. The Heading is at the very top right of the report. It contains the Credit

Bureau's information. The Credit Agency, their address, their phone number, and

the date the report was inquired upon.

PERSONAL INFORMATION

2. The next section of the report is the applicant's personal information. This

includes the Consumer's name, social security number, up to three different

addresses, date of birth (if available), and telephone number (if available).

TIP: Check the addresses against those submitted in the rental application. Do they

match? The addresses are located below the applicants Name with the most current

address directly below the applicants name and chronologically listed from there. The

employment and birth date information are located to the right of the applicant's

addresses and above the summary score. Former addresses and employment

information is inputted when a consumer applies for credit. Therefore it can or cannot be

a definitive verification of the last three residences or jobs.

EMPLOYMENT INFORMATION

3. This section of the report is the applicant's employment information. This

includes the company name, date hired (if available), income (if available),

occupation (if available), and separation date (if available).

TIP: Check the employment history against those submitted in the rental application Do

they match? The employment history may not necessary have the most current

information. Former addresses and employment information is inputted when a

consumer applies for credit. Therefore it can or cannot be a definitive verification of the

last three residences or jobs. . ALWAYS LOOK UP THE EMPLOYER PHONE NUMBER

YOURSELF

REPORT SUMMARY

4. Here is the overall summary of the applicant's credit history. This will tell you

the total number of accounts the applicant has, accounts that are still currently

active or negative or too new to be rated, accounts that are past due or paid off,

person(s) that have inquired upon the applicant's credit history, accounts that are

in collections or public records, total amount still owed, and a breakdown of the

amount.

SCORECARDS

5. The score summary, Experian/FICO, is above the applicants credit and trade

information and is the overall rating of the applicant's credit. Up to four factors are

disclosed and are displayed in order based on their relative impact on the final

score. Generally scores exceeding 625 are considered by banks as worthy of

loans. The lowest scores are in the low 400's and the highest scores close to 850

(Very few). Scores between 600 and 700 are very common and considered very

good. Most tenant applicants will fall between 550 and 650 credit scores. Scores

below 575 are considered a risk, and usually warrant further documentation or

higher security deposits if the landlord proceeds. (Note: No Hit means that the

consumer has no credit history whatsoever and nobody has even inquired upon

their credit history)

Number of accounts delinquent

Proportion of balance to high credit on bank revolving or all revolving accounts

Length of time (or unknown time) since account delinquent

COLLECTIONS

6. Identifies consumer accounts that have been transferred to a professional

debt-collecting firm. Collection information includes the name of the collection

agency providing the information, collector's kind-of-business designators, and

the consumer's account number with the collection agency. Also included is the

date the amount was charged off by the original creditor, date the information

was verified, the original dollar amount of collection, the balance owed as of date

verified or closed, name of the original creditor, and an explanation of current

account status as reported by the collection agency.

PUBLIC RECORDS

7. Public Records

information consists of bankruptcies against a consumer.

This information will include original

filing date with court,discharge status and status date,

liability and asset amounts

TRADELINES

8. Under the trade lines portion of the credit report, creditors report the amount of

loans and credit cards with payment histories. The name of the creditor is in the

left column, the credit amount information in the center column, and the payment

history is in the right column.

PAYMENT HISTORY

9. On the far right hand side of the report is the consumer payment history for

the past 24 months. These codes reflect the monthly status of an account and

are displayed for balance reporting loans. Collections and charge-offs are not

graded. These codes stand for:

INQUIRIES

10. This portion of the report is named inquiries. This is a list of companies that

have inquired about the applicant's credit, usually for the purpose of extending

new or additional credit. Numerous inquiries lower the applicant's summary score

by about two points per inquiry.

WARNINGS/MESSAGES

11. The last portion of the report is for warning messages. This is a list of

messages that are about the applicant's credit, social security number,

name, and/or address.

Leave a comment?